Market Dynamics and Key Drivers

Sustainable aviation fuel is derived from biofuels, which are produced using a variety of feedstocks such as oil seeds, corn grain, algae, forestry residues, agricultural residues, municipal solid waste, and other organic materials. The growing inclination toward innovative solutions supports governmental initiatives aimed at reducing carbon footprints. One of SAF’s most significant advantages is its ability to lower lifecycle greenhouse gas (GHG) emissions, thereby offering environmental benefits while also fostering economic sustainability. Governments and private sector entities continue to invest in SAF technologies, recognizing its potential to minimize aviation-related emissions.

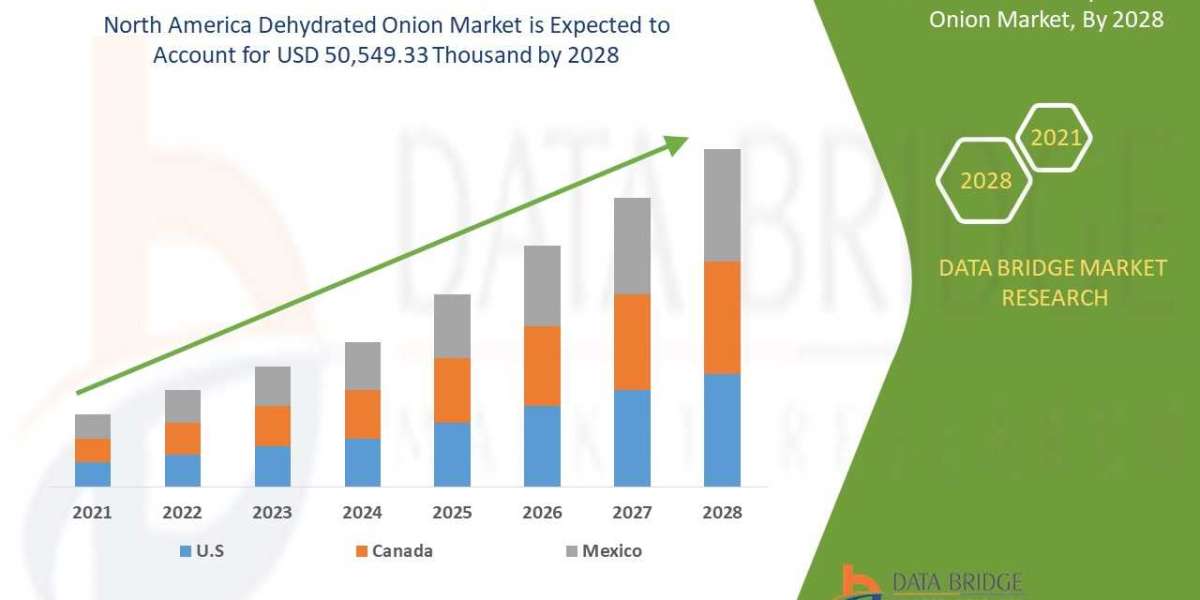

The expansion of the aviation sector, particularly across North America, including key markets such as Canada and Mexico, is expected to drive substantial demand for SAF. The availability of sustainable feedstocks for SAF production further reinforces market growth, paving the way for increased adoption in the coming years.

Challenges and Market Constraints

Despite its numerous benefits, the SAF industry faces certain obstacles that could limit its growth. One of the key challenges is that airlines cannot achieve their self-imposed targets for reducing GHG emissions solely through engine and flight optimizations—they require SAF integration. However, fuel costs represent a significant portion of airline operating expenses. Although SAF is produced from waste materials and low-cost feedstocks, its manufacturing process involves advanced and costly technological methods, which could hinder widespread adoption due to high production expenses.

Promising Advantages and Future Outlook

One of SAF’s most notable features is its drop-in capability, which enhances its demand as an effective means of lowering the aviation sector’s carbon footprint. As environmental concerns continue to escalate, the aviation industry is increasingly turning to SAF as a viable long-term solution. Commercial aviation, in particular, serves as a significant driver of SAF demand. Various companies and government organizations are actively investing in innovative manufacturing processes, striving to refine production techniques to achieve cost efficiency and scalability in the SAF market.

Market Segment Insights

- Regional Leadership: North America emerged as the dominant region in the global SAF market in 2024, generating the highest revenue. The region’s growth is attributed to factors such as rising airline passenger numbers, increased disposable income, the expansion of air transportation networks, and heightened usage of synthetic lubricants, all of which contribute to greater SAF adoption.

- Feedstock Type Dominance: Biofuels accounted for the largest market share in 2024 and are projected to maintain their leadership position. The segment’s growth is fueled by factors such as greater emphasis on renewable energy, environmental sustainability, and efforts to reduce GHG emissions.

- Technology Adoption: The FT-SPK (Fischer-Tropsch Synthetic Paraffinic Kerosene) technology led the end-use segment, generating over 44.0% of total revenue. FT-SPK is widely used because of its ability to produce high-quality, drop-in aviation fuel from various feedstocks, making it an attractive option for the industry.

- Platform Utilization: The commercial sector dominated the platform segment, accounting for the largest revenue share of over 33.0% in 2024. The increased deployment of SAF in commercial aviation underscores its growing importance in mitigating environmental impact and supporting sustainability goals.

Get a preview of the latest developments in the Sustainable Aviation Fuel Market? Download your FREE sample PDF copy today and explore key data and trends

Sustainable Aviation Fuel Market Segmentation

Grand View Research has segmented the global sustainable aviation fuel market based on fuel type, technology, aircraft type, platform, and region:

Sustainable Aviation Fuel Fuel Type Outlook (Volume, Million Liters; Revenue, USD Million, 2018 - 2030)

- Biofuel

- Hydrogen Fuel

- Power to Liquid Fuel

- Gas-to-Liquid

Sustainable Aviation Fuel Technology Outlook (Volume, Million Liters; Revenue, USD Million, 2018 - 2030)

- HEFA-SPK

- FT-SPK

- HFS-SIP

- ATJ-SPK

Sustainable Aviation Fuel Aircraft Type Outlook (Volume, Million Liters; Revenue, USD Million, 2018 - 2030)

- Fixed Wings

- Rotorcraft

- Others

Sustainable Aviation Fuel Platform Outlook (Volume, Million Liters; Revenue, USD Million, 2018 - 2030)

- Commercial

- Regional Transport Aircraft

- Military Aviation

- Business General Aviation

- Unmanned Aerial Vehicles

Sustainable Aviation Fuel Regional Outlook (Volume, Million Liters; Revenue, USD Million, 2018 - 2030)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- The Netherlands

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Malaysia

- Singapore

- Thailand

- Vietnam

- Latin America

- Brazil

- Argentina

- Middle East and Africa

- Saudi Arabia

- UAE

- South Africa

Key Players in the Sustainable Aviation Fuel Market

- Aemetis Inc.

- AVFUEL CORPORATION

- Fulcrum BioEnergy

- Gevo

- TotalEnergies

- LanzaTech

- Neste

- Preem AB

- Sasol Limited

- SkyNRG B.V.

- World Energy, LLC

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.