In recent times, the idea of investing in gold through Individual Retirement Accounts (IRAs) has gained significant traction amongst traders in search of to diversify their portfolios and safeguard their retirement savings. top gold ira investment providers IRA accounts allow people to spend money on bodily gold and different treasured metals as a part of their retirement strategy. This text explores the advantages and considerations of Gold IRA accounts, shedding gentle on why they could also be a prudent choice for sure buyers.

Understanding Gold IRA Accounts

A Gold IRA is a kind of self-directed IRA that enables investors to carry bodily gold, silver, platinum, and palladium of their retirement portfolios. In contrast to conventional IRAs, which sometimes encompass stocks, bonds, and mutual funds, a Gold IRA gives the chance to invest in tangible assets. The inner Income Service (IRS) regulates Gold IRAs, guaranteeing that the treasured metals meet particular requirements for purity and high quality.

Advantages of Gold IRA Accounts

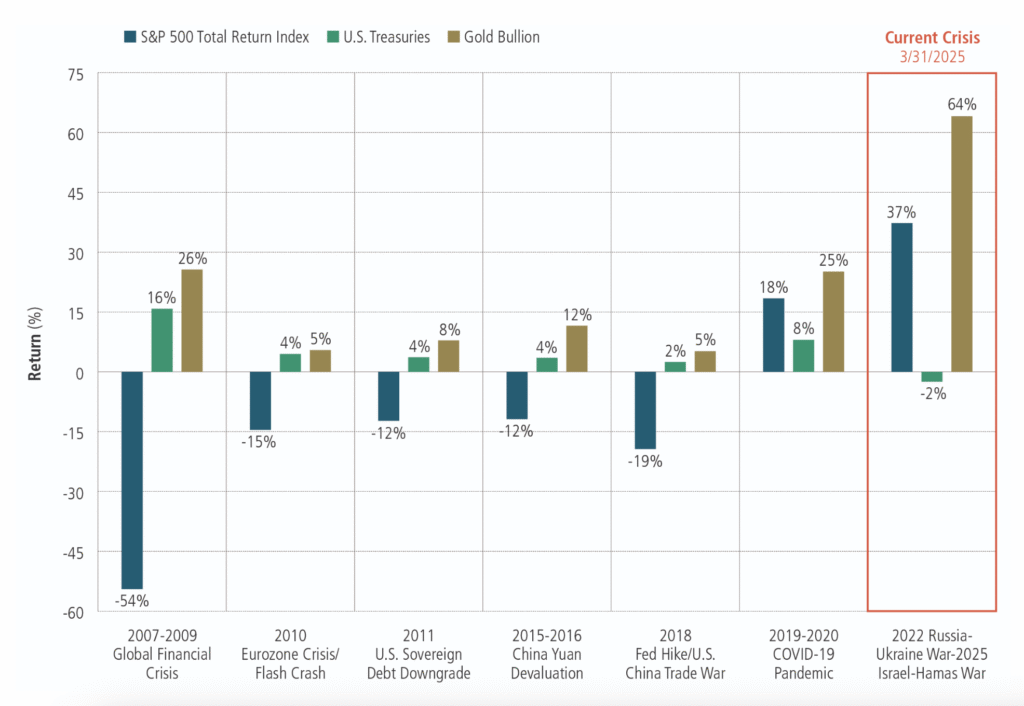

- Hedge Against Inflation: One in all the first benefits of investing in gold is its historical function as a hedge against inflation. As the value of fiat currencies tends to lower over time due to inflationary pressures, gold has maintained its purchasing energy. Traders usually flip to gold during financial uncertainty or intervals of high inflation, making it a reliable retailer of worth.

- Portfolio Diversification: A well-diversified investment portfolio can assist mitigate risk and enhance returns. By together with gold of their retirement accounts, traders can scale back their general portfolio volatility. Gold usually behaves differently than stocks and bonds, offering a counterbalance during market downturns. This diversification might be significantly useful for those nearing retirement, because it helps protect their financial savings from market fluctuations.

- Tax Benefits: Gold IRAs provide the same tax advantages as traditional IRAs. Contributions to a Gold IRA may be tax-deductible, and the investment grows tax-deferred until withdrawals are made throughout retirement. Moreover, if the Gold IRA is a Roth IRA, qualified withdrawals could also be tax-free. This tax efficiency can significantly enhance the overall returns on investment.

- Tangible Asset Ownership: Not like stocks and bonds, that are intangible property, gold is a physical commodity that investors can hold in their fingers. This tangibility supplies a sense of security for many investors, as they have a tangible asset that can be saved and secured. In instances of geopolitical instability or economic disaster, having bodily gold might be reassuring.

- Potential for Appreciation: Gold has traditionally demonstrated long-time period appreciation in value. While quick-time period value fluctuations are widespread, many traders view gold as an extended-time period investment. The demand for gold, pushed by factors similar to jewelry production, industrial purposes, and funding demand, can lead to cost increases over time.

Concerns When Investing in Gold IRA Accounts

While Gold IRA accounts provide several benefits, potential buyers also needs to consider the following factors:

- Prices and Fees: Setting up and maintaining a Gold recommended gold-backed ira companies usa can contain numerous fees, together with account setup charges, storage charges, and transaction fees. Buyers ought to fastidiously evaluate the fee construction of their chosen custodian and make sure that they understand all prices related to their Gold IRA. If you have any sort of concerns concerning where and how you can utilize https://www.refermee.com/companies/top-gold-ira-companies/, you can contact us at the site. These fees can impression general returns, so it is crucial to weigh them towards the potential benefits.

- Limited Funding Choices: Gold IRAs are subject to specific IRS laws relating to the kinds of precious metals that can be held in the account. Buyers can typically solely embrace gold that meets certain purity standards (e.g., 99.5% pure gold) and must select from authorized bullion coins and bars. This limitation may limit the investment choices available to buyers compared to conventional IRAs.

- Storage and Security: Bodily gold have to be saved securely to protect it from theft or harm. Gold IRA custodians sometimes provide storage safe options for investing in gold iras by means of third-party vaults, but traders ought to bear in mind of the ongoing storage charges and be sure that their gold is adequately insured. The security of the storage facility can be a important consideration, as buyers need to ensure their belongings are secure.

- Market Volatility: Whereas gold is commonly seen as a protected haven during economic uncertainty, it's not immune to market volatility. The value of gold can fluctuate primarily based on various factors, together with changes in curiosity rates, geopolitical events, and shifts in investor sentiment. Investors should be ready for potential value swings and have an extended-time period funding horizon.

- Regulatory Compliance: Gold IRAs must adjust to IRS rules, which may be advanced. Investors ought to work with a good custodian who's educated about the foundations governing Gold IRAs to make sure compliance. Failing to adhere to IRS guidelines may end up in penalties and taxes, which may erode the benefits of the investment.

Conclusion

Gold IRA accounts present a novel opportunity for buyers seeking to diversify their retirement portfolios and protect their financial savings from inflation and market volatility. The benefits of gold, including its historic position as a hedge against inflation, portfolio diversification benefits, and potential for appreciation, make it an appealing option for many. Nevertheless, investors must also consider the related costs, restricted funding choices, and regulatory compliance necessities.

Earlier than establishing a Gold IRA, individuals should conduct thorough research, seek skilled advice, and decide whether this investment aligns with their total monetary objectives and danger tolerance. With cautious planning and consideration, a gold ira investment for future security IRA can be a precious addition to a well-rounded retirement technique, offering both security and potential development for the future.

In conclusion, whereas Gold IRA accounts might not be appropriate for everybody, they provide a compelling various for buyers trying to safeguard their retirement financial savings with tangible property. As with every funding, understanding the dangers and rewards is crucial in making informed selections that will finally assist long-term monetary effectively-being.