In recent times, the appeal of investing in gold bars has surged, driven by financial uncertainties, inflation considerations, and a growing interest in tangible belongings. This article explores the current panorama of buying gold bars, including the advantages, market traits, and practical concerns for potential traders.

The Allure of Gold

Gold has long been thought to be a safe-haven asset, a store of value that tends to retain its buying power over time. Unlike fiat currencies, which might be printed at will, gold is a finite useful resource, making it a horny choice throughout periods of financial instability. Investors usually flip to gold as a hedge in opposition to inflation and forex devaluation, and the current world financial climate has solely intensified this development.

Why Buy Gold Bars?

- Tangible Asset: Unlike stocks or bonds, gold bars are bodily property that you can hold in your hand. This tangibility can present peace of mind, especially throughout monetary crises.

- High Purity: Gold bars typically have a higher purity degree than coins or jewelry. Most gold bars are at least 99.5% pure, which means you're investing in a high-quality product.

- Decrease Premiums: When buying gold bars, traders typically face decrease premiums over the spot price of gold compared to coins or other types of gold. This makes gold bars a cheap solution to invest in gold.

- Ease of Storage: Gold bars will be stored in a protected deposit field, dwelling safe, or specialized vaults, making them relatively easy to retailer compared to larger quantities of different property.

Current Market Tendencies

The marketplace for gold bars has evolved significantly, with a number of trends shaping how traders strategy this asset class:

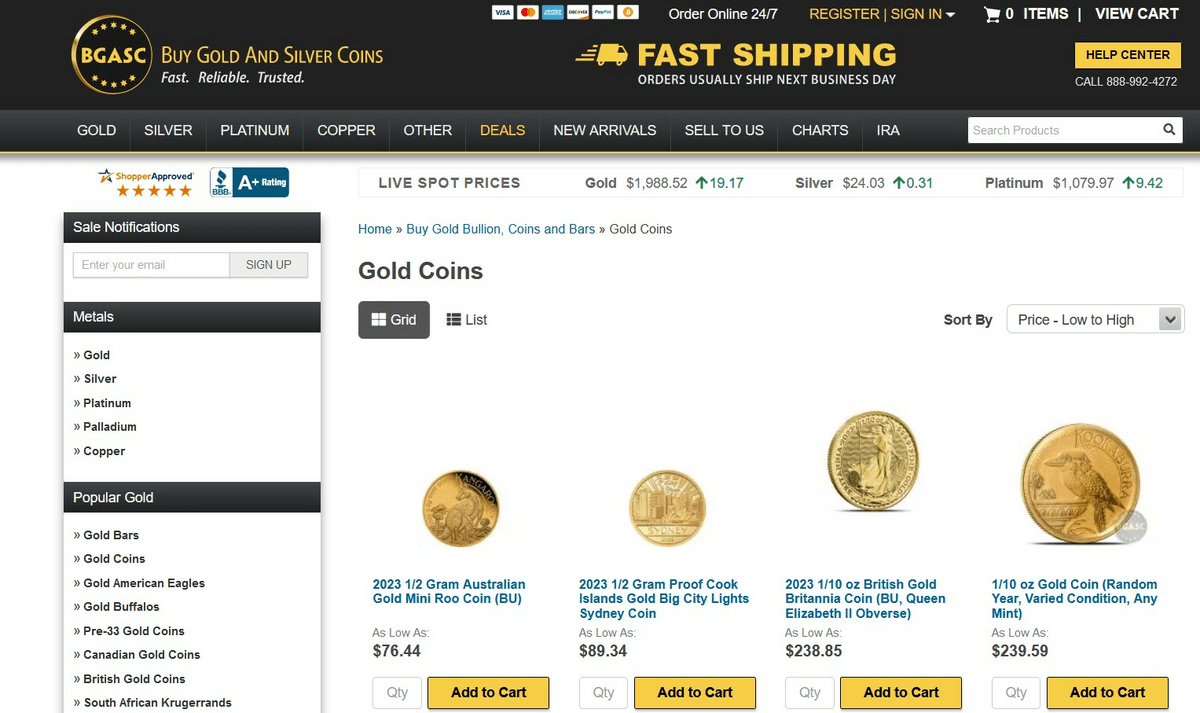

- Online Buying: The advent of e-commerce has reworked the best way to purchase gold people buy gold bars. Numerous respected on-line sellers now supply a wide collection of gold bars, allowing buyers to compare prices and make purchases from the comfort of their homes. Websites like APMEX, JM Bullion, and BullionVault present detailed data on pricing, availability, and transport choices.

- Fractional Gold Bars: Traditionally, gold bars had been out there in bigger weights, often beginning at one ounce. However, the market has seen a rise in fractional gold bars, that are smaller and more reasonably priced. This development caters to a broader viewers, allowing more folks to invest in gold without committing to a full ounce or extra.

- Increased Demand from Retail Traders: The COVID-19 pandemic has heightened consciousness of the importance of diversifying investment portfolios. In consequence, more retail buyers are turning to gold bars as a protected funding option. This surge in demand has led to elevated production and availability of gold bars in various sizes.

- Sustainable Gold Sourcing: With rising considerations in regards to the environmental affect of mining, many traders are looking for ethically sourced gold. Some sellers now supply gold bars that include certifications proving that the gold was mined responsibly, interesting to socially acutely aware traders.

How to Buy Gold Bars

If you’re contemplating investing in gold bars, here are some steps to guide you through the process:

- Analysis Dealers: Start by researching respected sellers. Look for companies with constructive evaluations, clear pricing, and a stable observe record within the trade. Verify their accreditation with organizations comparable to the better Business Bureau (BBB) or the Skilled Numismatists Guild (PNG).

- Perceive Pricing: Gold prices fluctuate primarily based on market circumstances, so it’s important to grasp the current spot price of gold. Dealers typically sell gold bars at a premium above the spot value, which might vary primarily based on the bar's weight, model, and market demand.

- Choose the best way to invest in gold and silver Measurement: Determine on the scale of the gold bars you want to buy real gold online. Consider your budget, funding targets, and storage capabilities. Smaller bars may be more manageable and easier to liquidate, whereas larger bars could provide higher worth per ounce.

- Secure Storage: Once you buy gold bars, consider how you'll retailer them. Choices embody dwelling safes, financial institution security deposit boxes, or third-get together vaults. Every option has its execs and cons, so select one that aligns with your security needs and convenience.

- Keep Documentation: Maintain information of your purchases, together with invoices and certificates of authenticity. This documentation is crucial for resale functions and will help establish the provenance of your gold bars.

Selling Gold Bars

In some unspecified time in the future, it's possible you'll decide to promote your gold bullion bars. Understanding the resale market is crucial:

- Market Situations: The worth of gold bars can fluctuate primarily based on market situations. Keep an eye on gold costs and consider selling when costs are favorable.

- Choose a good Buyer: When selling, go for a good seller or marketplace. Many on-line platforms help you sell gold bars on to buyers, but ensure that you are aware of any charges concerned.

- Perceive Premiums: Simply as when shopping for, selling gold bars could contain premiums. Be prepared for the likelihood that you may not receive the full market worth if promoting to a vendor, as they will sometimes offer a value below the present market fee.

Conclusion

Investing in gold bars can be a rewarding endeavor, offering a tangible asset that has historically maintained its worth. With the rise of on-line purchasing and elevated curiosity from retail traders, the landscape for buying gold bars has by no means been extra accessible. By understanding current developments, conducting thorough research, and contemplating practical points of storage and resale, investors can make knowledgeable selections that align with their financial targets. As always, diversifying your investment portfolio and consulting with financial advisors can additional improve your investment strategy in the dynamic world of gold bars.